Turbotax enter home improvements

To claim home improvement expenses on your taxes, you can enter them in the “Deductions & Credits” section of “Turbotax enter home improvements”. Look for the “Your Home” section and then enter the expenses under the “Home Expenses” category.

Home Improvements

Home improvements encompass a wide array of enhancements made to residential properties. These projects aim to elevate functionality, aesthetic appeal, and value. Whether you’re a seasoned homeowner or a first-time buyer, home improvements play a pivotal role in shaping your living space.

Turbotax enter home improvements

“Turbotax enter home improvements” feature simplifies the process of reporting home upgrades for maximum tax benefits. With an easy-to-use interface, users can efficiently input details such as the type of improvement, cost, and completion year. TurboTax provides real-time calculations of potential deductions, ensuring transparency and accuracy. The platform’s expert guidance and up-to-date knowledge of tax laws make it a reliable partner for homeowners seeking to optimize their tax returns. Turbotax not only streamlines the filing process but also empowers users to file with confidence, knowing they’ve maximized their tax benefits related to home improvements.

How to enter home improvements with Turbotax?

When using Turbotax, you can enter home improvements under the “Deductions & Credits” section. Look for the “Home Expenses” category and then select “Home Improvement Expenses” to enter the details. Go through with following steps to complete the procedure;

- Firstly you need to create your Turbotax account.

- Now select your Tax Situation.

- Turbotax completes various tax situations, ensuring that you receive the relevant guidance for your specific needs. Whether you’re a homeowner or renter, TurboTax has tailored solutions.

- After entering your your basic information, head to dedicated home improvements section. Turbotax will prompt you to provide details about the improvements you’ve made to your property.

- Enter all the details accurately such as type of improvement, cost, and the year the work was completed.

- Then Turbotax provides you real-time calculations of potential tax deductions.

- You can file your taxes now.

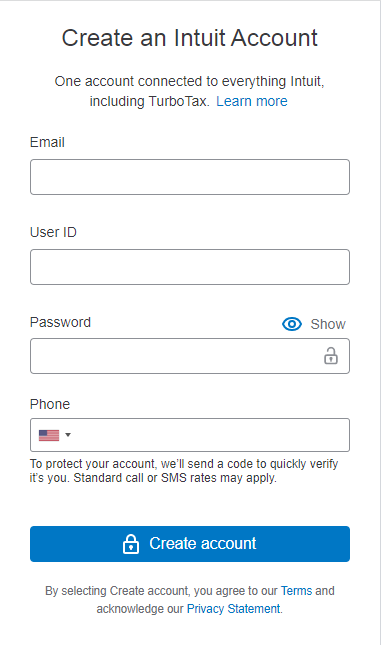

How to create Turbotax account?

- Go to the official Turbotax website “Turbotax.ca/download”.

- Turbotax offers various products based on your tax situation. Select the one that best fits your needs.

- Click on the “Create an Account” button.

- Provide your email address, create a password, and follow any additional prompts.

- Check your email inbox for a verification message from TurboTax. Click on the provided link to verify your email address.

- Choose a security method to protect your account, such as two-step verification via text or email.

What types of home improvements are eligible for tax deductions?

Home improvements that can qualify for tax deductions include energy-efficient upgrades such as solar panels, geothermal heat pumps, or energy-efficient windows and doors. Additionally, certain medical renovations for accessibility purposes or home office expenses may also be eligible for tax deductions. Always check with a tax professional to ensure your specific home improvements qualify.